Let's Maximize Your Employee Retention Credits!

We’re American Incentive Advisors, and we specialize in maximizing ERTC for Small Businesses. Schedule your consultation today, and let’s take your business to new heights, together.

ERTC is a refundable payroll tax credit program

The Employee Retention Tax Credit (ERTC) was created by Congress to help employers affected by Covid-19.

$5000

For the 2020 tax year

Up to $5k per employee for 2020

$21000

For the 2021 tax year

Up to $21k per employee for 2021

The Employee Retention Credit

COVID-19 brought about challenges for all of us. While the world shut down around us, the economy collapsed, leaving the future of many businesses in uncharted territory. As we finally begin to find some sense of normalcy again, businesses now have to focus on recovery and fortunately, there are several government programs available to help.

One of these programs is the Employee Retention Tax Credit or ERTC, which is a stimulus program designed to assist those businesses that were able to retain their employees during this challenging time. Due to the extremely complex tax codes and qualifications, it is severely underutilized. Some program details are:

UP TO $26,000 PER EMPLOYEE

AVAILABLE FOR 2020 & Q1 - Q3 2021

QUALIFY WITH DECREASED REVENUE OR COVID EVENT

NO LIMIT ON FUNDING (ERTC IS NOT A LOAN)

ERTC IS A REFUNDABLE TAX CREDIT

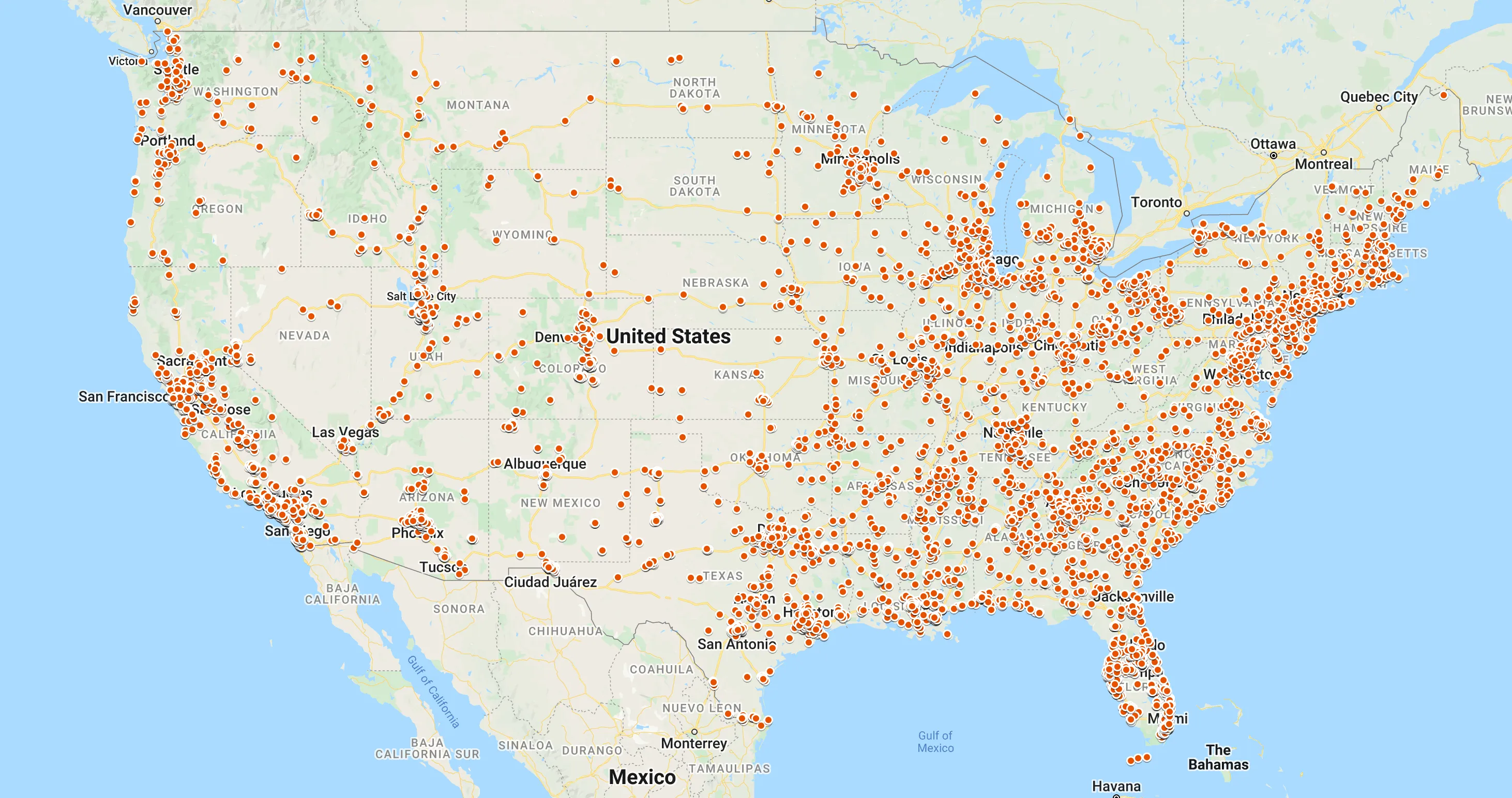

Recovering Employee Retention Tax Credits In All 50 States!

American Incentive Advisors has secured over One Billion Dollars in ERTC for small businesses in 2022

Seamless Process from start to finish

American Incentive Advisors will handle your claim in a smooth and seamless manner resulting in the maximum funds recovered on your behalf.

01. Initial Consultation

The first step is your initial consultation to determine if your business qualifies. During the consultation, we will give you a list of documents and items that you will need to send back to us. For your convenience, we provide a secure upload portal for you to upload the required payroll documentation and PPP information.

02. Review Documentation

Once we have the required documents, one of our expert advisors will conduct a no cost analysis to determine all the available credits your business qualifies for. Your advisor will review your documentation to maximize your credit with the IRS and advise on all options, confirm your eligibility and begin the process to secure your funding.

03. Processing Your Claim

If you choose to move forward, you would sign our agreement and select your desired payment option so we can submit your revised 941 forms to the IRS and start your claim. The entire process typically takes 4-6 months from start to finish.

04. Receive Your Funds

Once the claim is filed, refunds will be released based according to the IRS’s availability schedule. Currently, the IRS has stipulated a 20 week minimum turnaround for ERTC refunds. Once step 3 is complete, your funds will be released in the form of a check from the IRS.

Ready to get started?

Schedule a free consultation today with our knowledgeable and experienced team of experts to learn how American Incentive Advisors can help maximize your company’s ERTC credits.

(512) 582-6038

What Our Clients Are Saying

Schedule a free consultation today with our knowledgeable and experienced team of experts to learn how American Incentive Advisors can help maximize your company’s ERTC credits.

We want to hear from you

Schedule Consultation

Tell us a little about your business. One of our ERTC experts will be in touch with you shortly to schedule your free consultation.